ONE: IGlobal AC Shipments Surging: ONE’s Market Insights Reveal Why

Dear valued customer,

Global air conditioner shipments are rising due to climate change and economic shifts.

Ocean Network Express (ONE)’s analysis reveals the key trade lanes and factors driving this logistics boom.

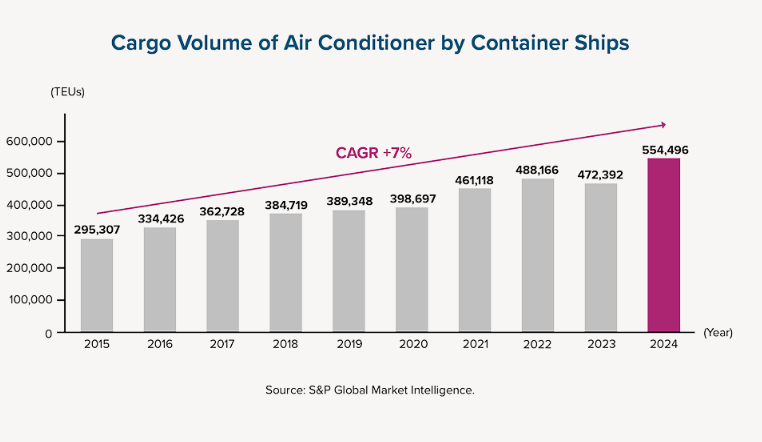

A confluence of record global temperatures, proactive government energy policies, and large-scale economic development is fueling a sustained increase in the ocean freight volume of air conditioners. As the United Nations reports that 2024 was the hottest year in recorded history, the ripple effects are reshaping key trade lanes from manufacturing hubs in Asia to meet surging demand in North America, the Middle East, and Europe. For shippers and logistics professionals, this isn’t a simple story of rising temperatures alone; the surge is driven by a complex interplay of consumer needs, government incentives, and shifting manufacturing strategies. Understanding the dynamics of these key trade lanes is now essential for navigating this expanding market and building a resilient supply chain.

Insight 1:

Why is North America sourcing more AC units from diverse Asian hubs?

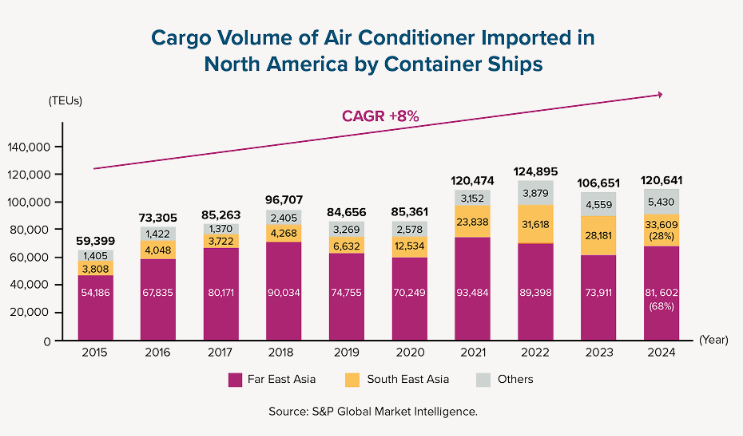

The challenge for the North American market is twofold: responding to extreme weather in new regions and meeting government-stimulated demand for energy-efficient technology. Rising summer temperatures and unprecedented heatwaves now affect areas previously known for cool summers, such as the U.S. Pacific Northwest and Canada’s British Columbia. Simultaneously, the 2022 U.S. Inflation Reduction Act (IRA) has created powerful financial incentives for consumers to adopt energy-efficient products, spurring a wave of replacement demand for high-efficiency heat pumps and an increase in the importation of parts for domestic assembly.

The data shows a clear response. The volume of air conditioners shipped to North America has grown at a compound annual growth rate (CAGR) of 8% between 2015 and 2024. Critically, the manufacturing origin for these goods is diversifying. While Far East Asia remains the dominant supplier, the share of cargo from Southeast Asia has skyrocketed from just 6% in 2015 to 28% in 2024. This strategic shift is a direct response to U.S.-China trade friction and rising labor costs, prompting manufacturers to increasingly leverage countries like Vietnam, Thailand, and Malaysia as cost-effective production bases.

Insight 2:

What’s fueling the 7% annual growth in AC shipments to the Middle East?

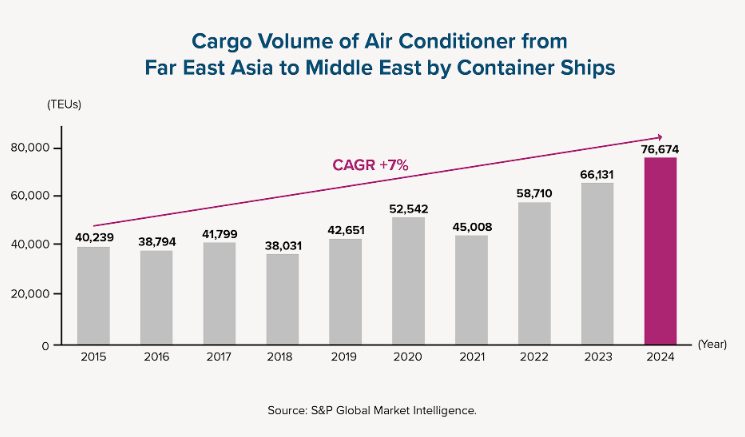

In a region already defined by an arid climate, the primary problem is the intensification of extreme heat. With summer temperatures now frequently exceeding 40°C (104°F) and even reaching 50°C (122°F), air conditioning has become an indispensable part of daily life and work. This fundamental need is amplified by strong economic tailwinds, including rising disposable income that makes air conditioners more accessible to a wider consumer base.

This demand is reflected in the steady 7% CAGR for air conditioner shipments from Far East Asia to the Middle East over the last decade. The most significant impact on future logistics comes from the region’s historic transformation, driven by ambitious urban development giga-projects like NEOM and New Murabba in Saudi Arabia. These initiatives involve constructing entire cities and downtown districts where air conditioning is standard equipment in all new buildings. This embeds massive, long-term demand directly into the region’s infrastructure, signaling a need for scalable and reliable supply chain solutions for years to come.

Insight 3:

How are EU regulations creating a new type of demand for air conditioners?

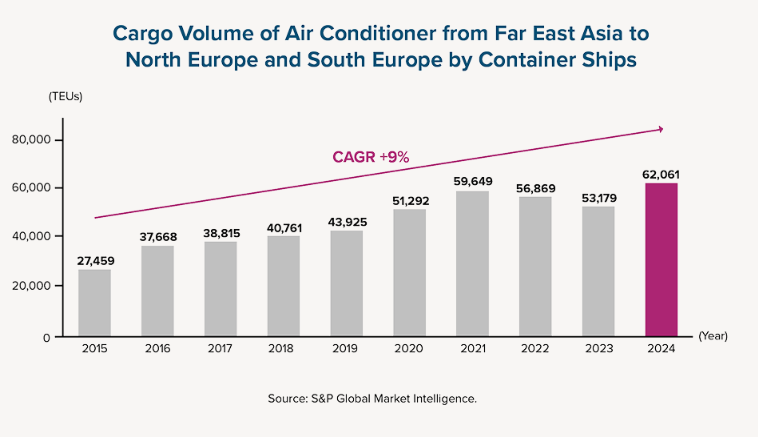

Like other regions, Europe is grappling with more frequent and intense summer heatwaves, driving a foundational need for cooling. However, the European market presents a unique challenge: demand is being actively shaped by some of the world’s most stringent environmental regulations. The EU’s strategy is to phase out old technology through the Eco-design Directive and F-Gas Regulation while simultaneously incentivizing new, high-efficiency technology through programs linked to the European Green Deal.

This regulatory landscape dictates the type of products being shipped, shifting the market toward advanced, eco-friendly heat pumps and air conditioners that use low-GWP refrigerants. The result is a 9% CAGR in shipments from Far East Asia to Europe since 2015, but with a growing premium on specific, compliant products. For manufacturers and their logistics partners, the impact is clear: success in the European market requires not just volume capacity, but the ability to manage a supply chain for technologically advanced and highly regulated goods.

Powering the Cooling Industry

The underlying drivers of climate change, policy, and economic development suggest this growth is set to continue, with projections indicating the global sea freight volume for air conditioners may grow at a CAGR of 3% through 2035. Navigating this evolving landscape requires a logistics partner with a resilient and extensive service network connecting key manufacturing hubs in Asia with high-demand markets globally. As trade dynamics shift and cargo diversifies from finished units to component parts, flexibility and expertise are paramount. Ocean Network Express provides the global reach, specialized solutions, and scalable capacity needed to master the complexities of the air conditioner supply chain and ensure your products reach their destination reliably.

Related Posts