Seatrade Maritime: Return to Suez could stifle intra-Asia container rate boost

Intra-Asia container rates have been boosted by rising demand, but while demand is predicted to be maintained throughout next year, rate could slump as cascaded capacity is brought in from other trades.

A potential end to the conflict in Gaza and the subsequent reopening of the Suez Canal could have a detrimental effect on the world’s biggest regional trades in Asia where growth has replaced much of the US freight that was a casualty of the Trump administration’s tariff regime.

Intra-Asian trade growth is patchy, but remains substantial in India and China where the PMI data shows expansion every month for the last year, except in May when China’s manufacturing contracted, while other parts of the continent, have seen the tariff regime as an opportunity.

Alphaliner recently reported that CMA CGM was leading the way in terms of Suez transits with some of its services already scheduled to make the journey.

Hapag-Lloyd CEO Rolf Habben Jansen has said the company has a plan for returning to the Red Sea route, waiting to be implemented.

Meanwhile, Vespucci consultant Lars Jensen believes that if the ceasefire holds then the period immediately after Chinese New Year could be the optimum time for the transition to begin.

A return to Suez by the top 10 lines will see something in the order of 2 million teu released onto an already crowded market as large ships are cascaded into secondary markets, which would have a major impact on regional rate levels, which have been rising since September.

Drewry’s supply chain consultant Stijn Rubens, however, believes that the top 12 carriers have already begun shifting vessels into the region, with some 325,000 teu deployed in the intra-Asia trades in 2023, rising by 22% to 396,000 teu this year, according to Drewry data.

Responding to Lars Jensen’s view that a return to Suez may start in the lull immediately after Chinese New Year, Rubens said, “That’s also in our forecasts”.

“There is an option where the carriers are likely to switch westbound vessels via Suez and return to Asia via the Cape,” with the high value cargo going the quickest route, explained Rubens, “Returning by the Cape of Good Hope just to absorb the capacity.”

According to Drewry by continuing to route eastbound ships via the Cape carriers could absorb some 10% of the capacity.

Rubens believes the impact of this returning tonnage could prove to be catastrophic for the regional freight rates, which have climbed to $667 per feu and with China sending intermediate goods for finishing to Vietnam and other Asian countries, notably Indonesia, demand will continue to rise, but the influx of new vessels could kill the rate rises dead.

Tariffs will not stop the diversification of production, according to Rubens: “It’s like a game of whack-a-mole,” he said, “If you raise tariffs on one, then the other will start doing the assembly work”.

China diversification was meant to see India benefit with European and US East Coast freight and Vietnam with US West Coast cargo.

“Vietnam and India appear to be the biggest beneficiaries of this [tariffs],” added Rubens, who does not believe that tariffs will prevent the shift in production.

“I’m not sure they’ll spend a lot of time trying to whack them all,” quipped Rubens.

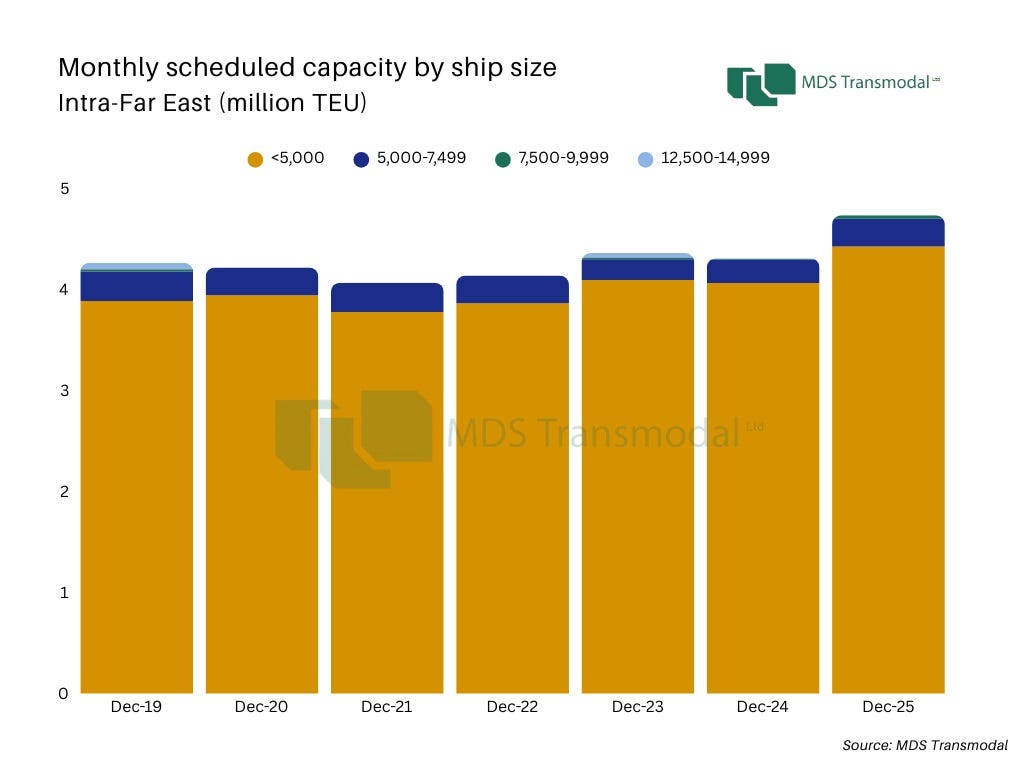

Drewry believes that there could be a cascade of larger ships even though historically the trades have been served almost exclusively by sub-5,000 teu vessels, though the level of capacity has increased.

MDS Transmodal analyst Antonella Teodoro points out that, “Despite the growth in intra-Far East capacity, its share of global capacity has slightly decreased since 2019.”

Teodoro argues that while the intra-Asian market is expanding, other trade corridors, particularly those utilising larger vessels, are growing at a faster pace, including the intra-Europe and Med, Gulf and Indian Subcontinent – Far East, Far East – North America and Europe and Med – Far East “Are amongst the trade corridors to report the biggest percentage increases since 2019.”

Vessels over the 7,500 teu size are not deployed in any numbers in the regional services, but it is not port infrastructure that is the limiting factor.

“In practice, however, the trade continues to be dominated by smaller vessels because shorter distances and the need for frequent, flexible services make smaller ships more efficient. Port limitations matter selectively, but they are not the primary driver of vessel size decisions, in intra-Asia services,” explained Teodoro.

Meanwhile, Dynamar analyst Darron Wadey expects the cascading impact to hit other trades first, limiting the effects on the intra-Asia trades before the cascade hits the Far East market.

“I think that operational practicalities mean that (other things – especially demand – remaining equal), it will not be as severe and will be not as bad as it could be at first glance,” said Wadey.

The expectation would be to see the negative rate impacts of capacity being freed up on other routes first, Wadey explained, for example, West African trades have already seen the very largest ships call during this period of diversions.

“By the time the cascade has reached the intra-Asia trade, and after multiple steps of the cascade, the negative impacts may well have diminished,” added Wadey.

According to MDS Transmodal data scheduled intra-Asia capacity has increased by approximately 10% year-on-year, and by 11% compared to 2019 levels, signalling consistent expansion in the intra-regional market.

The sector is still dominated by vessels under 5,000 teu, which account for around 94% of the capacity.

Related Posts