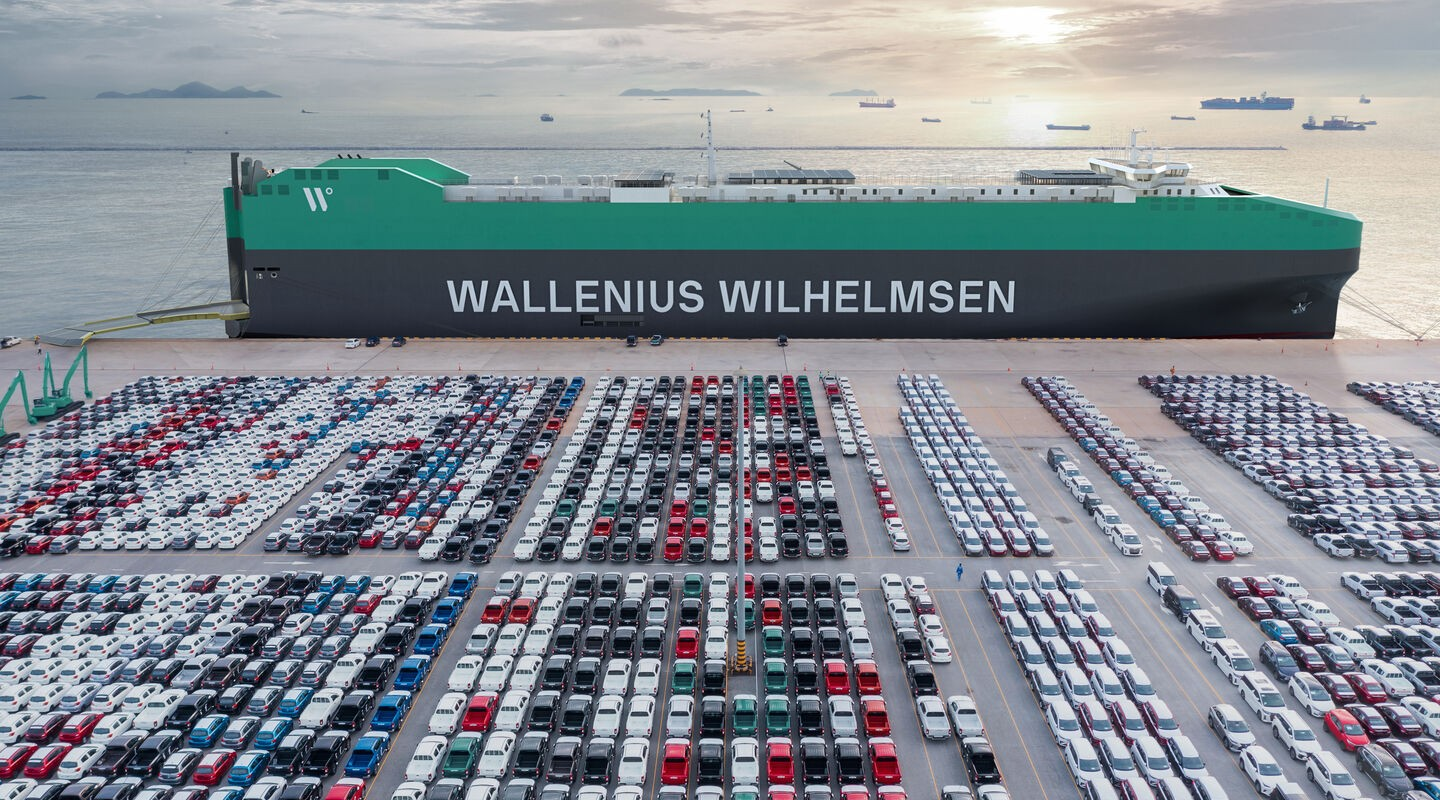

Shippingtelegraph: Wallenius Wilhelmsen newbuildings get dual-fuel LNG and methanol engines

by Shipping Telegraph

Norway’s car carrier operator Wallenius Wilhelmsen is planning half of the so-called Shaper class 14 vessels on order to be equipped with dual-fuel LNG engines and seven with dual-fuel methanol engines.

The company made an adjustment during the second quarter to the engine configuration for seven out of the 14 Shaper class vessels on order.

To diversify the sourcing of fuel and prepare for future sustainable fuels like ammonia, seven newbuildings will be equipped with dual fuel LNG engines and seven with dual fuel methanol engines, the car carrier giant said during its second quarter earnings on Tuesday.

The LNG capable vessels will have fuel tanks capable of carrying ammonia. Through the Shaper class newbuilding program Wallenius Wilhelmsen now will be able to source all types of conventional fuels, including bio-based and electricity based fuels like methanol and ammonia in the future.

The delivery schedule of the newbuildings remains unchanged, Wallenius Wilhelmsen said, with deliveries scheduled between 2026 and 2028.

At the end of the quarter, Wallenius Wilhelmsen controlled a fleet of 127 vessels (down one QoQ) of which 116 vessels controlled by the shipping services segment and 11 by the government services segment.

Meanwhile, Wallenius Wilhelmsen entered in Q2 into an agreement to sell the 30-year old vessel Don Juan. The vessel is expected to be delivered to its new owners in the third quarter and to result in a gain in excess of $15m.

Wallenius Wilhelmsen maneuvered steadily through the second quarter with an EBITDA of $472m.

“We see the strong demand, in particular in shipping, continuing into Q3 and maintain our financial outlook for the year, expecting 2025 adjusted EBITDA to be in line with 2024,” says Lasse Kristoffersen, president and CEO of Wallenius Wilhelmsen.

Total revenue for Q2 was $1,350m, an increase of four percent quarter over quarter due to strong volumes for the shipping segment.

The EBITDA for Q2 of $472m is an increase of two percent quarter over quarter, mainly driven by the shipping segment.

Net profit for the period totaled $403m with $135m explained by a capital gain following the sale of the MIRRAT terminal. Without the sales gain, net profit for the period would have been $268m, up eight percent QoQ, the company said in its second quarter report.

Related Posts